2023 will certainly not go down as the best year in the history of the property industry. It was a year characterised by challenges and uncertainties, particularly in terms of transactions and prices. In this article, we will highlight the most important developments of the past property year and take a look at what we can expect in 2024.

A clear feature of the property year was the marked decline in transaction activity, accompanied by price falls of 10-20%. For investment properties in particular, prices fell by more than 20% in some cases. This was due to a number of factors, including economic uncertainties, global events and changes in investment strategies. Investors who had previously relied on solid returns were faced with new challenges. Adapting strategies and closely analysing the market became key components of success in this difficult environment.

Old building condominium stabilisation

While the investment spectrum was characterised by price declines, prices for condominiums in older buildings showed a certain stabilisation. This could be due to the continuing popularity of historic properties and the charm associated with them. However, it should be noted that this stabilisation was accompanied by rising ancillary costs. Flat owners were confronted with higher operating costs, which was a pronounced factor in the decision-making process of prospective buyers.

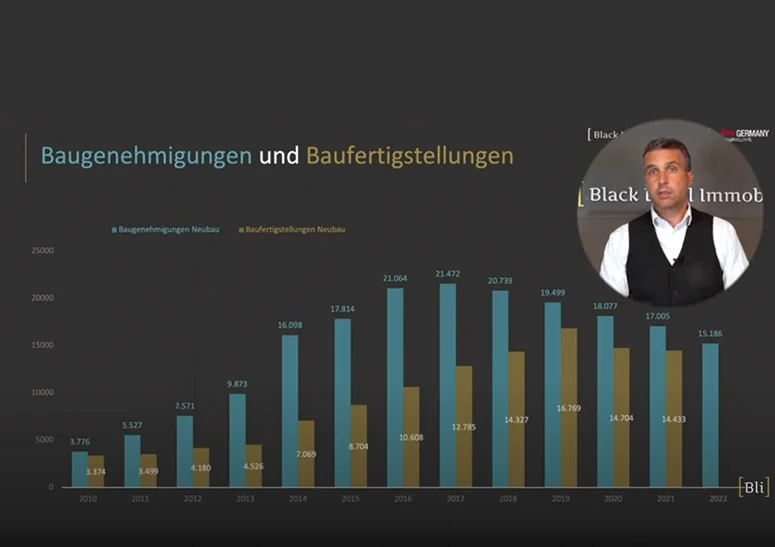

Challenges in the new construction market

In contrast to the stabilisation of older properties, new-build properties had to contend with considerable problems. One of the main reasons was the increasing difficulty of ensuring energy efficiency without driving up costs. Prices in the new-build market were also an area that challenged the sector. Many potential buyers were hesitant due to high costs and uncertainties surrounding the development of energy efficiency.

Exceptions for prime locations and high-energy properties

Despite the general problems in the new-build segment, there were exceptions. High-priced prime locations and energy-efficient properties retained their appeal. A certain degree of stability was recorded in these exclusive areas, and buyers continued to show interest in these top properties.

Interest rate trends and increased demand

There was a short-term positive development in December, when interest rates fell temporarily. This led to increased demand from prospective buyers who wanted to take advantage of the favourable interest rate environment. Interest rate trends will continue to play a decisive role in 2024 and should be closely monitored by buyers and investors.

Reluctance to invest in energy-efficient refurbishment and renewable energies

One notable trend that emerged in 2023 was a reluctance to invest in energy-efficient refurbishment and the use of renewable energies. Uncertainty regarding political decisions and subsidy programmes contributed to the reluctance of many owners and investors to invest in this area. Despite this reluctance, there is a favourable window of opportunity for decisions in this area. In time, clarity and stability should return and those who act early could reap the long-term benefits of sustainable property development.

Time frame for buyers: 3-6 months

Statistically speaking, buyers have a window of 3-6 months in which they can act favourably. This provides some flexibility before the market is likely to correct and supply becomes tighter. Thorough market analysis and sound decision making will be critical to identifying and capitalising on the best opportunities.

Conclusion and forecast for 2024

The 2023 real estate year was undoubtedly characterised by challenges, but as in any industry, there are also opportunities for those who recognise and skilfully exploit them. As the market evolves, close analysis, adaptability and a willingness to respond to new developments will be crucial. For 2024, interest rate developments will continue to be a focus, as will the industry’s adaptation to new realities. Buyers, sellers and investors should prepare for a dynamic property landscape and follow developments closely in order to make informed decisions. In the property industry, knowledge is power, and those who are well informed will be successful even in challenging times.

Overview: Summary of the year 2023 in the property sector

The 2023 property year was characterised by a noticeable decline in transaction activity, which was accompanied by price falls of 10-20%. Investment properties in particular saw declines of over 20% in some cases. This development can be attributed to various factors, including economic uncertainties, global events and changes in investment strategies. Investors who previously relied on solid returns were confronted with new challenges that required them to adapt their strategies and analyse the market in detail.

While the investment spectrum was characterised by price declines, prices for condominiums in older buildings showed a certain stabilisation. This could be due to the continuing popularity of historic properties and the charm associated with them. However, it should be noted that this stabilisation was accompanied by rising ancillary costs, which posed a challenge for homeowners when making a decision. In contrast, new-build properties faced considerable problems, particularly with regard to the increasing difficulty of ensuring energy efficiency without driving up costs. Prices in the new build market were also a challenge, causing potential buyers to hesitate due to high costs and uncertainty.

However, high-priced prime locations and energy-efficient properties were exceptions, which retained their appeal and continued to attract interest from investors. A short-term positive development was seen in December, when interest rates fell temporarily and triggered increased demand from prospective buyers looking to take advantage of the favourable interest rate environment. Interest rate trends will continue to play a decisive role in 2024 and should be closely monitored by buyers and investors.

A notable trend in 2023 was the reluctance to renovate energy-efficient properties and use renewable energies due to political uncertainties and a lack of subsidy programmes. Statistically, there is a window of 3-6 months for buyers to act favourably before the market is likely to correct and supply becomes tighter. Thorough market analysis and informed decision making will be crucial to identify and capitalise on the best opportunities.

Despite the challenges in 2023, there are opportunities for those who are well informed and act skilfully. Accurate analysis, adaptability and a willingness to respond to new developments will continue to be crucial in 2024. Interest rate trends and the industry’s adaptation to new realities will be in focus, and buyers, sellers and investors should keep a close eye on the dynamic property landscape in order to make informed decisions. In the property industry, knowledge is power: Knowledge is power, and those who are well informed will be successful even in challenging times.